Some Known Facts About Financial Planner Minneapolis.

Table of ContentsGetting My Financial Planner Minneapolis To WorkThe Ultimate Guide To Financial Planner MinneapolisNot known Incorrect Statements About Financial Planner Minneapolis Not known Facts About Financial Planner MinneapolisFinancial Planner Minneapolis Can Be Fun For Anyone

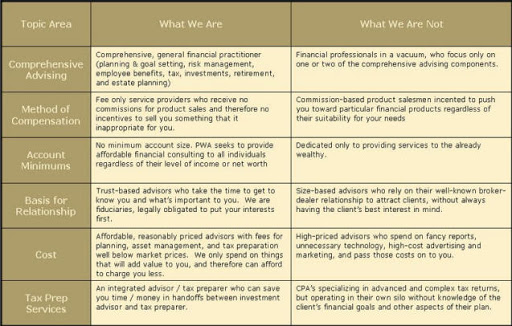

Customers are provided with a wide range of economic experts, all of whom may be striving for their business. "Financial consultant" and "financial organizer" are preferred titles for people that assist consumers manage their money. Every monetary planner is also a kind of monetary expert, yet every financial consultant is not always a financial organizer.Financial Advisor This is a wide term for a specialist who helps handle your money. You pay the advisor, and also in exchange, they assist with any type of variety of money-related jobs. An economic expert may assist take care of investments, broker the sale and also purchase of supplies as well as funds, or develop an extensive estate as well as tax plan.

In enhancement to that permit, there are several other economic consultant qualifications the expert might hold, depending upon the solutions that are offered. "Financial consultant" as a basic term consists of subsets of the financial consultant group, such as financiers, insurance coverage agents, cash supervisors, estate coordinators, lenders, as well as a lot more. Assume of the contrast between a financial expert versus a financial coordinator like a funnel with the financial consultant ahead. financial planner Minneapolis.

The Bottom Line A lot of individuals that need cash aid will certainly get an economic planner, which is a more certain sort of monetary consultant. But the choice pertaining to the "type" of monetary coordinator calls for some examination. Before hiring a coordinator to assist with your funds, ensure to understand what you are spending for.

Unknown Facts About Financial Planner Minneapolis

Numerous financial advisors provide economic preparation, yet monetary planners only function within that location. On the other hand, monetary organizers are typically less investment-centric, whereas financial consultants can provide an equilibrium between investing and economic preparation.

Ideally, you would certainly discover somebody that has experience functioning with clients in situations comparable to your very own. While you're on the search, bear in mind that "monetary consultant" as well as "economic coordinator" are broad groups.

You can go straight to the CFP web site to locate an CFP near you or to validate an advisor's qualification. Before working with an economic planner or financial consultant, ensure you comprehend what you're spending for. It can be testing to find out what recommendations you require, but it can be also harder to know if you are getting it at a fair cost.

7 Simple Techniques For Financial Planner Minneapolis

The expense will certainly depend on a few factors, like exactly how the specific expert or organizer is made up and whether they will certainly offer their consultatory solution on a continuous basis. Because of that, we can't generalise that will be extra pricey than the other. Advisors are usually compensated in among 3 methods: fee-only, fee-based or by compensation.

Some advisors may also charge a flat rate or hourly charge. The majority of monetary experts and also planners will certainly charge between $1,500 as well as $2,500 for a full financial strategy, $300 to $500 by the hr or 0.

Bear Get More Information in mind that consultants are employed to provide advice and make referrals. You make weblink the final decision on who you employ, and you're complimentary to keep asking inquiries until you have actually come to a decision you fit with. If your front runner isn't the appropriate fit, you can always work with a various expert.

Fee-based experts, on the other hand, can likewise make commissions from offering items, like insurance authorities. Financial experts typically have advisory accreditations, which can offer you a concept of the subjects they're most efficient in. As stated above, monetary coordinators typically hold accredited economic organizer (CFP) or hired monetary professional (Ch, FC) classifications.

Little Known Facts About Financial Planner Minneapolis.

Whether you're purchasing mutual funds or aiming to change your wide range with an economic plan, you might be taking into consideration functioning with a monetary consultant. Financial investment advisors and monetary organizers are 2 of one of the most usual sorts of economic advisors that customers collaborate with. These advisors inevitably offer advice on different financial subjects, but one point they have in usual is finance.

Advisors collaborating with clients should hold the Series 65 certificate. Could have several safety and securities licenses to sell investment products, consisting of Collection 3, Series 6, and Series 7 tests - financial planner Minneapolis. As we point out in the table over, a financial investment advisor helps you with managing your financial investments and securities to ensure that you'll have a more information strong financial investment profile.

This implies they must legally place client monetary rate of interests. While fee-based advisors have a fiduciary obligation to their clients, commission-based experts do not. This is comparable for economic coordinators.